eEXCISE STAMP COMPLIANCE

Nicotine, Tobacco and Alcohol Production:

Traceability for Compliance

In June 2023, the Verkhovna Rada of Ukraine adopted Law No. 3173-IX, introducing an electronic excise tax stamp system to enhance the traceability of alcoholic beverages, tobacco products, and liquids used in electronic cigarettes. PSQR is here to help you ensure compliance.

The Ukrainian government is increasing digital control in the tobacco and alcohol industries.

This will require companies to prove the legality of goods, including alcohol, tobacco products, and liquids for electronic cigarettes.

Ukraine’s eExcise tax stamp and traceability programme is coming into force in 2026.

ABOUT THE eEXCISE STAMPS

Secure Labels for Product Visibility

The eExcise system will consist of secure labels carrying

serialized data matrix codes for application to the individual packs and other types of packaging, as well as to the outer packaging for aggregation purposes.

- The labels allow the movement of alcohol, tobacco products and liquids for e-cigarettes to be tracked from the manufacturer/importer to the final consumer

- Consumers can also scan the labels using the e-governance Diia app and access product information

REGULATORY COMPLIANCE

Ensuring Compliance with Traceability

With our traceability solutions, companies can effectively complete business operations while ensuring the fulfilment of the governmental requirements:

- Replacing paper excise tax stamps with digital ones

- Generating unique stamps with an unforgeable code

- Monitoring the movement of alcohol, tobacco products, and liquids for electronic cigarettes through the supply chain

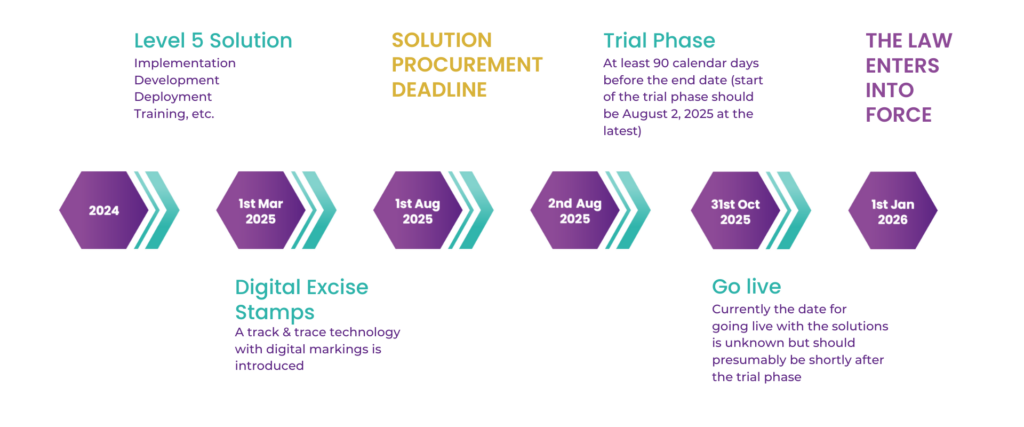

Compliance Timeline

Would you like our help?

If you’d like to learn more about our solution and how it can help you business ensure staying on the Ukranian market, please fill out the form below to let our team of experts better understand your needs and come up with a tailored solution for your case.